Ready to make your first foray into the world of stock trading? With limitless opportunities for building a secure financial future through knowledgeable investments, it’s no wonder why so many people are interested in learning about trading stocks. But with all the complex terminology and strategies, understanding stock trading can seem overwhelming – even intimidating.

That’s why we’ve put together this ultimate stock trading cheat sheet. In this article, you’ll learn fundamental concepts such as analysing risk vs reward and reading market indicators, plus time-saving tips on staying competitive in today’s markets. Read on to get savvy with critical skills every trader needs to know.

What is stock trading, and how does it work

Stock trading is the buying and selling of ownership stakes in companies through a stock exchange. When an investor purchases a stock, they are buying part-ownership of that company, and in return, they receive voting rights, dividends (if declared) and other benefits. Investors can also make money when stocks go up in value; by reselling them, the investor can benefit if the stock has increased in price since its purchase.

Stock trading involves researching and predicting current market conditions so investors can determine when to buy and sell stocks to maximise their advantages, although there is no guarantee of success. There are countless strategies for trading stocks, with experienced traders often using more sophisticated methods than those just starting in trading. No matter what investment experiences you have, though, beginning to learn about stock trading can be both interesting and exciting.

The different types of orders you can place when trading stocks

When trading stocks, investors have various order types to choose from. These orders are designed to help investors carry out their trading strategies by providing flexibility and control over buying and selling stocks.

The most common types of orders include market orders, limit orders, stop-loss orders, trailing stop-losses, and margin accounts. Market orders allow for the purchase or sale of securities at the current market price; limit orders instruct brokers to buy or sell at specific price points; stop-losses place an automatic “sell” order when a stock drops below a predetermined level; and trailing stop-losses adjust themselves as the value of security rises or falls.

Additionally, margin accounts provide traders access to additional funds to purchase more stocks than they could. By taking advantage of these different order types, investors can tailor their strategies to the current market and maximise their opportunities.

How to read a stock chart

A stock chart is a visual representation of how the price of a stock has changed over time. Stock charts provide investors with information such as the direction and magnitude of price changes, opening and closing prices, and trading volume. By studying these charts, traders can identify significant trends and make informed decisions when trading stocks.

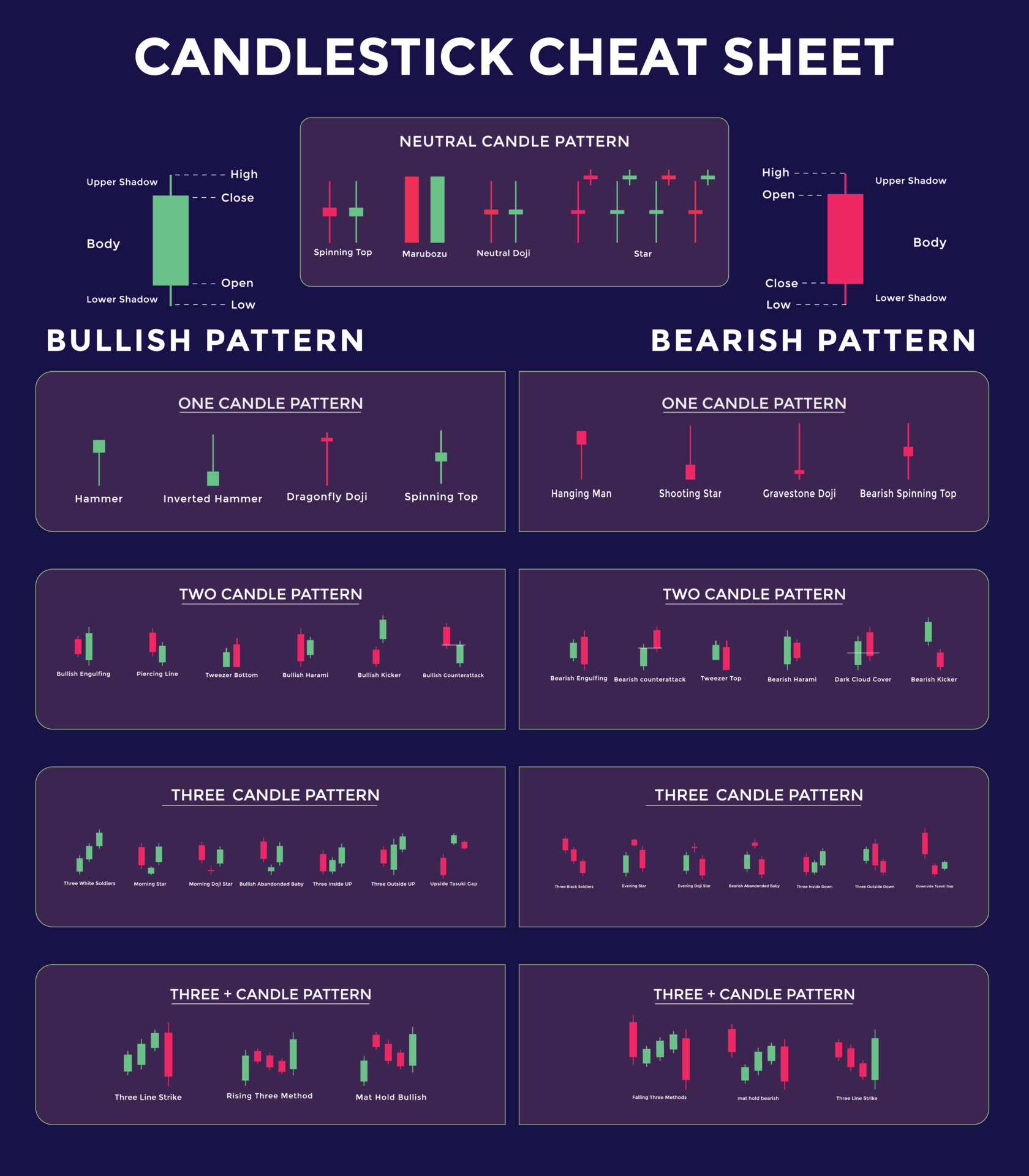

To read a stock chart, look at the x-axis to find out the specific dates for which data is provided, then observe the y-axis to determine what values are being plotted on the chart. Most often, this will be either prices or trading volumes; other indicators, such as moving averages, may also be present. Depending on the type of chart you’re looking at (bar chart, candlestick chart, etc.), the data will be interpreted differently.

Additionally, chart patterns can provide traders with valuable insight into market trends and help them identify potential buying and selling opportunities. For example, a “head and shoulders” pattern can indicate that the stock price is nearing its peak, while a “cup and handle” pattern may suggest that a breakout is imminent. By becoming familiar with common chart patterns, traders can gain an edge in the markets.

Tips for beginner traders

Trading stocks can be an intimidating experience, especially for those who are just starting. To become a successful trader, you need to have knowledge of the markets and understand how to read stock charts.

Beginners should start by focusing on one market at a time and researching different types of securities; this will help them build up their understanding of the markets before moving on to more complex investments. Additionally, they should familiarise themselves with different order types to know what strategies to use in various scenarios.

It’s also crucial for beginners to invest only money they can afford to lose; this way, it will have little impact if something goes wrong. Finally, traders should continuously diversify their portfolios by investing in various types of assets.

Conclusion

The ultimate stock trading cheat sheet provides investors with essential information and advice for trading stocks. Understanding different order types, reading stock charts, and taking essential precautions are all vital elements of successful stock trading. Following the tips outlined in this article, traders can gain an edge in the markets and maximise their opportunities.